Our Firm

|

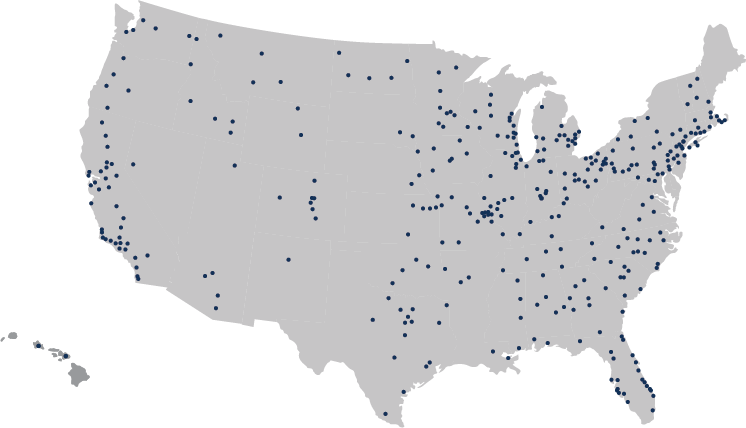

As a Stifel Financial Advisor, Mark P. Goddard has the support of and access to the deep resources of one of the nation's leading financial services firms. His affiliation with Stifel enables him to maintain the independent thinking and entrepreneurial spirit essential to help clients pursue their financial goals.

Stifel, Nicolaus & Company, Incorporated is a full-service securities brokerage, investment banking, trading, and investment advisory firm founded in 1890. The company is a registered investment adviser with the U.S. Securities and Exchange Commission.

Our parent company, Stifel Financial Corp., went public in 1983 and has traded on the NYSE since 1987 (symbol “SF”).

|

|

Our equity research has ranked in the top 10 of the StarMine Analyst Awards for 14 consecutive years (includes Keefe, Bruyette & Woods (KBW), a wholly owned subsidiary of Stifel Financial Corp., and other firms acquired by Stifel). For more information about the Refinitiv StarMine Analyst Awards, see www.stifel.com/research.

STIFEL SERVICES

Annuities | Variable, Immediate, Fixed Indexed, and Fixed Education Planning | 529 Education Savings Plans Insurance | Business Owner Needs |

Investment Banking IRAs |

Stifel does not offer legal or tax advice. You should consult with your legal and tax advisors regarding your particular situation.

Lending services for clients of Stifel, Nicolaus & Company, Incorporated are performed exclusively by Stifel Bank and Stifel Bank & Trust (Stifel Banks). Stifel Bank, Member FDIC, Equal Housing Lender, NMLS# 451163, is affiliated with Stifel Bank & Trust, Member FDIC, Equal Housing Lender, NMLS# 375103, and Stifel, Nicolaus & Company, Incorporated, Member SIPC & NYSE, each a wholly owned subsidiary of Stifel Financial Corp. Unless otherwise specified, references to Stifel may mean Stifel Financial Corp. and/or any of its subsidiaries. Unless otherwise specified, products purchased from or held by Stifel are not insured by the FDIC, are not deposits or other obligations of Stifel Banks, are not guaranteed by Stifel Banks, and are subject to investment risk, including possible loss of the principal.

Understanding Stifel Pledged Asset (SPA) Loans:

Speak with your Financial Advisor about your risk tolerance level, market fluctuations, and specifically the potential risks associated with a Stifel Pledged Asset (SPA) Line of Credit.

Securities-based lines of credit involve risk and are not appropriate for all borrowers. The SPA Line of Credit is a full recourse, demand loan using the assets in a brokerage account as collateral and can be called at any time. An increase in interest rates will affect the overall cost of borrowing. The return on your securities must be higher than your financing cost in order for you generate a positive return in your securities account. The market value of your securities may decline, which may result in the value of that collateral no longer covering an outstanding loan amount. In either event, the borrower may be required to post additional collateral and/or repay part or all of any outstanding loan. Stifel Bank & Trust may call the loan, and sell or force the sale of the assets in the collateral account, or any other collateral, without contacting the borrower. The borrower will not be able to select which securities will be sold. The borrower can lose more assets than the borrower is required to deposit in the collateral account. The borrower is responsible for satisfying any amount not covered by the collateral. The borrower is not entitled to an extension of time to meet a collateral maintenance call.

If collateral is sold, this could result in an unfavorable tax event for the borrower. Neither Stifel nor our affiliates provide legal or tax advice. Borrowers should consult with their legal and tax advisors.

Learn more about the potential risks involved with securities-based lending: www.stifel.com/Lending#Disclosures.

Trust and fiduciary services are provided by Stifel Trust Company, N.A. and Stifel Trust Company Delaware, N.A. (Stifel Trust Companies), wholly owned subsidiaries of Stifel Financial Corp. and affiliates of Stifel, Nicolaus & Company, Incorporated, Member SIPC & NYSE. Unless otherwise specified, products purchased from or held by Stifel Trust Companies are not insured by the FDIC or any other government agency, are not deposits or other obligations of Stifel Trust Companies, are not guaranteed by Stifel Trust Companies, and are subject to investment risks, including possible loss of the principal invested. Stifel Trust Companies do not provide legal or tax advice.